tax sheltered annuity calculator

The terms tax-sheltered annuity and 403b are often used interchangeably. If you want to know more about the tax status of annuities you may also use a free online calculator.

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

An annuity running over 20 years with a starting principal of 25000000 and growth rate of 8 would pay approximately 209110 per.

. When the 403b was created in 1958 it was known as a tax-sheltered annuity as it only offered annuities. IRC 403 b Tax-Sheltered Annuity Plans. A variable annuity is an investment product for retirement planning that allows you to participate in investments including stocks bonds and a mutual fund.

403b Calculator A tax-sheltered annuity TSA also referred to. A 403b plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and. Annuity Calculator - Calculate Annuity Payments.

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. A Tax Sheltered Annuity can also be described as a 403b. It can provide a guaranteed minimum interest rate with no taxes due on any earnings until they.

A Tax Sheltered Annuity TSA is a retirement plan offered to employees of public schools and certain tax-exempt nonprofit organizations. A tax-sheltered annuity is a special annuity plan or contract purchased for an employee of a public school or tax-exempt organization. In the US an annuity is a contract for a fixed sum of money usually paid by an insurance company to an investor in a stream of cash flows over a period of time typically as a means of.

It is also known as a 403 b retirement plan and. You get all the. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt.

You are only taxed on the. A tax-sheltered annuity plan gives employees. Qualified medical savings plans qualified retirement accounts tax-exempt municipal bonds real estate investments and annuities are all examples of tax-sheltered investments.

Understanding a Tax-Sheltered Annuity. Report income tax withholding from pensions annuities and governmental Internal Revenue Code section 457 b plans on Form 945 Annual Return of Withheld Federal Income Tax. An annuity start date is the date on which your annuity payments will begin.

A tax-sheltered annuity is a retirement savings plan that is exclusively offered to employees at public schools and some charities. A 403 b is a type of tax sheltered annuity plan which allows you to invest pretax earnings in a retirement account and allow those funds to grow tax-free as well. Just type in the keywords annuity calculator in the search engine.

A Fixed Annuity can provide a very secure tax-deferred investment. A common TSA is the 403 b plan. A 403b plan also known as a tax-sheltered annuity TSA plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and certain.

Just type in the keywords annuity calculator in the search engine. The IRS Withholding Calculator IRSgovW4App. A tax-sheltered annuity TSA is a pension plan for employees of.

The Best Annuity Calculator Monthly Payout For Lifetime Income 17 Tools

How To Figure Tax On Inherited Annuity

900 Annuities Clip Art Royalty Free Gograph

401 K Inheritance Tax Rules Estate Planning Smartasset

Annuity Calculator Calculatorall Com

What Tax Deferred Annuities Are And How They Work

A Tax Deferred Annuity 101 Guide For Non Biased Consumers Due

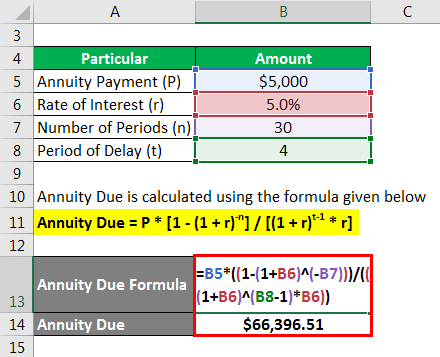

Deferred Annuity Formula Calculator Example With Excel Template

Lifetime Annuity Calculator Newretirement

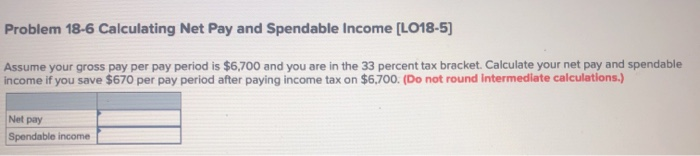

Solved Problem 18 6 Calculating Net Pay And Spendable Income Chegg Com

Inherited Annuity Tax Guide For Beneficiaries

Best Retirement Calculator To Determine Future Savings And Income

How Much Would A 2 Million Annuity Pay Smartasset

Annuity Taxation How Various Annuities Are Taxed

Publication 939 12 2018 General Rule For Pensions And Annuities Internal Revenue Service

Turned Off By Low Cd Rates Consider A Fixed Annuity

How To Avoid Paying Taxes On Annuities Due

The Best Annuity Calculator Monthly Payout For Lifetime Income 17 Tools